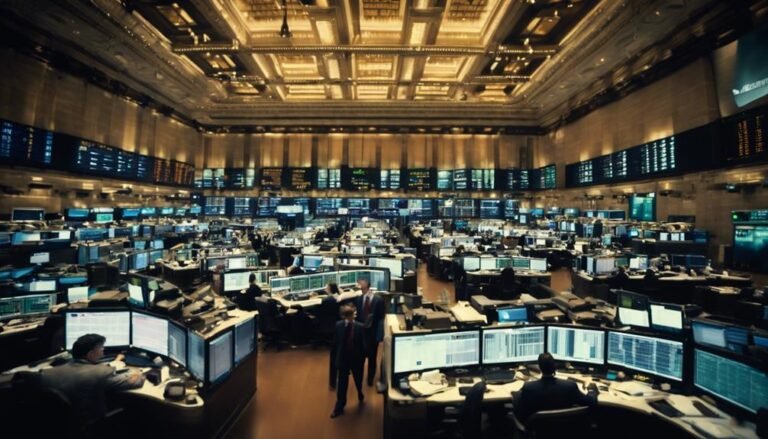

Algorithmic Trading and Its Impact on Markets

Algorithmic trading has revolutionized markets by automating trade execution and enhancing risk management through intricate algorithms. It plays a pivotal role in market liquidity, impacting order execution and market efficiency. Market volatility is influenced by increased trading volumes and flash crashes, creating a more fragmented market landscape. Regulatory bodies are continuously adapting to monitor these changes and uphold market integrity. Moving forward, trends point towards machine learning, predictive analytics, and real-time data analysis in algorithmic trading. Risks like market manipulation and ethical concerns are addressed through robust risk management measures. Understanding these dynamics is key to maneuvering the evolving market environment.

Key Takeaways

- Algorithmic trading enhances market efficiency and liquidity.

- Market volatility is influenced by increased algorithmic trading.

- Regulatory bodies implement surveillance technologies to ensure market integrity.

- Future trends include machine learning and alternative data integration.

- Risk management is crucial to mitigate financial and ethical risks.

Evolution of Algorithmic Trading

The evolution of algorithmic trading can be traced back to the late 20th century when advancements in technology and financial markets converged to revolutionize trading practices. The historical development of algorithmic trading saw a shift towards automation in trading, where complex mathematical models and algorithms were employed to execute trades with speed and efficiency. Algorithmic strategies emerged as a result of quantitative analysis gaining prominence in financial markets, allowing traders to leverage data-driven insights to make informed decisions. These trading algorithms are designed to identify patterns, execute trades, and manage risk in a systematic and disciplined manner.

The integration of algorithmic strategies into trading practices marked a significant milestone in the financial industry, enabling market participants to capitalize on opportunities that traditional manual trading methods could not exploit. As technology continues to advance, algorithmic trading is expected to further evolve, enhancing market liquidity, efficiency, and transparency. The adoption of algorithmic trading has reshaped the landscape of financial markets, setting new standards for trading practices and risk management.

Advantages of Algorithmic Trading

Harnessing sophisticated algorithms in trading operations confers a competitive edge by swiftly executing trades based on predefined parameters. Algorithmic trading offers several advantages, primarily in the domains of risk management and the implementation of trading strategies. By automating the trading process, algorithms can react to market conditions in real-time, enabling faster trade execution and reduced transaction costs. Additionally, algorithmic trading allows for the implementation of complex trading strategies that may be difficult to execute manually.

| # Advantages of Algorithmic Trading |

|---|

| Efficient trade execution |

| Enhanced risk management |

| Diversification of trading strategies |

Efficient trade execution is a key benefit of algorithmic trading, as it minimizes the impact of market fluctuations on trade prices. Enhanced risk management is another advantage, with algorithms capable of setting predefined risk parameters and automatically executing trades based on these limits. Furthermore, algorithmic trading enables the diversification of trading strategies across various assets and markets, leading to a more robust and balanced portfolio. By leveraging these advantages, market participants can optimize their trading operations and stay ahead in today's dynamic financial landscape.

Impact on Market Liquidity

The impact of algorithmic trading on market liquidity is a critical aspect that demands attention. Understanding the dynamics of liquidity in trading, implications on market depth, and the effects of high-frequency trading are essential components of this discussion.

Analyzing these points can provide valuable insights into how algorithmic trading influences the availability and stability of liquidity in financial markets.

Liquidity Dynamics in Trading

Amidst the intricate interplay of various factors influencing market dynamics, liquidity in trading stands as a crucial element shaping the efficiency and stability of financial markets.

Liquidity providers play a pivotal role in maintaining market liquidity by offering to buy or sell assets, thereby facilitating smooth transactions.

Trading strategies heavily rely on the availability of liquidity, with high-frequency trading (HFT) strategies being particularly sensitive to changes in liquidity conditions.

Market participants closely monitor liquidity dynamics to gauge the ease with which assets can be bought or sold without impacting their prices to a large extent.

Understanding the interplay between liquidity providers, trading strategies, and market conditions is essential for investors and regulators in evaluating the overall health and resilience of financial markets.

Market Depth Implications

Market liquidity, influenced considerably by liquidity dynamics in trading, is further shaped by the implications of market depth on trading conditions.

- Market depth affects the ease of order execution.

- Deeper markets usually lead to more efficient price discovery.

- Thin markets with shallow depth may result in wider spreads.

- High market depth can provide more stability during volatile periods.

- Traders often prefer markets with greater depth for increased liquidity and reduced slippage.

Understanding market depth implications is important for market participants as it directly impacts trading strategies, execution quality, and overall market stability. By analyzing market depth, traders can make more informed decisions regarding order placement, risk management, and optimizing trading performance.

High-Frequency Trading Effects

High-Frequency Trading has a significant impact on the liquidity of financial markets due to its rapid execution speeds and high trading volumes. This form of trading provides speed advantages that can lead to market manipulation if not properly regulated. High-Frequency Trading strategies often focus on exploiting small price discrepancies across multiple assets, contributing to fluctuations in market liquidity.

While it can enhance market efficiency by facilitating price discovery and narrowing bid-ask spreads, there are concerns regarding its potential to disrupt market stability. Risk mitigation is essential in high-frequency environments to guarantee orderly order execution and prevent excessive volatility.

Regulators continue to monitor these activities closely to maintain a fair and transparent trading environment while balancing the benefits and risks associated with high-frequency trading.

Role in Market Volatility

In the realm of financial markets, algorithmic trading plays a crucial role in shaping and worsening market volatility through its swift execution of trades based on predefined quantitative models. This phenomenon can have significant implications for market stability and efficiency. Here are some key points to ponder:

- Increased Trading Volumes: Algorithmic trading can result in a surge in trading volumes, which may magnify price swings and market fluctuations.

- Liquidity Concerns: While algorithmic trading can boost market liquidity, it can also swiftly withdraw liquidity during volatile periods, causing sudden price changes.

- Feedback Loop: Algorithms responding to market movements can create a feedback loop, where rapid price changes trigger further algorithmic actions, potentially intensifying volatility.

- Flash Crashes: The use of intricate algorithms can contribute to sudden and severe market downturns known as flash crashes, where prices plummet in a very short time.

- Market Fragmentation: Algorithmic trading across multiple platforms can fragment the market, leading to disjointed price movements and increased volatility.

These factors highlight how algorithmic trading can impact market volatility and underscore the need for effective risk management strategies to mitigate potential negative impacts.

Regulatory Challenges and Responses

Regulatory challenges in the sphere of algorithmic trading necessitate robust compliance measures to uphold market integrity.

The adoption of sophisticated market surveillance technologies has become imperative to monitor trading activities effectively.

As regulators adapt to the evolving landscape, the efficacy of these responses will play a pivotal role in maintaining a fair and orderly market environment.

Regulatory Compliance Measures

Implementing effective compliance measures in algorithmic trading environments is crucial for maintaining market integrity and investor protection. To address regulatory challenges and guarantee compliance automation, firms can consider the following measures:

- Utilizing pre-trade risk controls to prevent erroneous trades.

- Implementing post-trade surveillance mechanisms for real-time monitoring.

- Conducting regular audits and reviews of algorithms for compliance.

- Ensuring transparency in algorithmic decision-making processes.

- Collaborating with regulatory bodies to stay updated on evolving compliance requirements.

Market Surveillance Technologies

Market surveillance technologies play a pivotal role in monitoring and detecting market misconduct and ensuring regulatory compliance within algorithmic trading environments. Surveillance technology trends are continuously evolving to keep pace with the complexities of modern markets.

These technologies utilize advanced algorithms to analyze vast amounts of trading data in real-time, flagging any suspicious activities that may indicate market manipulation. Market manipulation detection is a key focus of these surveillance systems, which aim to maintain market integrity and fairness.

Regulatory bodies rely heavily on these technologies to detect anomalies, enforce compliance, and investigate potential violations promptly. As markets continue to advance, surveillance technologies must adapt to new trading strategies and technologies to effectively safeguard market integrity.

Future Trends in Algorithmic Trading

The evolution of algorithmic trading continues to shape the future landscape of financial markets through innovative strategies and advanced technologies. As we look ahead, several key trends are emerging in the domain of algorithmic trading:

- Increased Utilization of Machine Learning Algorithms: Firms are increasingly leveraging machine learning algorithms to enhance trading strategies, improve decision-making processes, and optimize trade execution.

- Expansion of Predictive Analytics Strategies: The use of predictive analytics strategies is on the rise, allowing market participants to forecast market trends, identify potential risks, and seize opportunities with greater accuracy.

- Integration of Alternative Data Sources: Traders are incorporating a diverse range of alternative data sources, such as social media sentiment analysis and satellite imagery, to gain unique insights and make more informed trading decisions.

- Focus on Real-Time Data Analysis: There is a growing emphasis on real-time data analysis capabilities to enable faster reactions to market fluctuations and capitalize on fleeting opportunities.

- Continued Emphasis on Risk Management: As algorithmic trading becomes more sophisticated, there is a continued focus on developing robust risk management protocols to mitigate potential pitfalls and safeguard market stability.

Risks and Ethical Considerations

Given the expanding landscape of algorithmic trading and the adoption of advanced technologies in financial markets, it is imperative to address the potential risks and ethical considerations associated with these developments. Ethical implications in algorithmic trading revolve around issues such as market manipulation, fairness, and transparency. Algorithms can execute trades at speeds beyond human capability, raising concerns about market integrity and fairness. In addition, the use of complex algorithms may lead to unintended consequences, such as flash crashes or cascading sell-offs, highlighting the importance of robust risk management practices.

Risk management is a critical aspect of algorithmic trading to mitigate financial losses and systemic risks. Algorithms are designed to identify and capitalize on market inefficiencies, but they can also amplify market volatility and pose systemic risks if not properly monitored. Implementing circuit breakers, position limits, and stress testing algorithms are critical to prevent excessive risk-taking. Additionally, ensuring algorithms are regularly monitored and reviewed can help detect and address potential issues promptly. By balancing innovation with ethical considerations and effective risk management, the financial industry can harness the benefits of algorithmic trading while safeguarding market stability and integrity.

Conclusion

To sum up, algorithmic trading has revolutionized financial markets by enhancing efficiency and providing liquidity.

While some may argue that algorithmic trading can worsen market volatility, proper regulations and risk management strategies can alleviate these concerns.

As technology continues to advance, the future of algorithmic trading looks promising, but it is essential to take into account the risks and ethical implications associated with this practice.