Technology’s Role in Modern Wealth Management Trends

Did you know that technology is revolutionizing the wealth management industry and empowering financial advisors with cutting-edge tools? From artificial intelligence (AI) to digital solutions and fintech innovations, technology is reshaping the way wealth management is conducted.

Key Takeaways:

- Technology is transforming the wealth management industry at an unprecedented scale.

- Artificial intelligence (AI) is playing a prominent role in enhancing advisors’ decision-making processes.

- Tech stack integration is crucial for improving productivity and efficiency.

- Emerging fee models are driving the demand for software solutions to support accurate billing.

- New applications are expanding advisors’ services, enabling them to meet diverse client needs.

The Rise of Artificial Intelligence in Wealth Management

Artificial intelligence (AI) has emerged as a significant trend in the wealth management industry, transforming the way financial advisors operate. With the integration of machine learning and generative AI, advisors can now make more informed decisions and provide a higher level of service to their clients.

One of the key applications of AI in wealth management is through AI-powered communications. Customized chatbots and other AI-driven tools are increasingly being used to facilitate personalized interactions with clients. These tools enable advisors to provide tailored recommendations, answer client queries, and deliver relevant information in real-time.

The use of AI in wealth management extends beyond communication tools. Advisors are leveraging AI algorithms to generate personalized content for their clients, ensuring that the information shared is relevant and valuable. This personalized approach enhances the client experience and builds trust.

“AI-powered communications and personalized content have revolutionized the way advisors interact with their clients. The ability to deliver tailored recommendations and provide relevant information in real-time has become a game-changer in the industry.”

Furthermore, AI is playing a crucial role in shaping financial planning solutions. By leveraging AI algorithms, advisors can analyze vast amounts of data to develop comprehensive financial plans that meet the individual needs and goals of their clients. These AI-powered solutions enable advisors to provide more accurate assessments and make data-driven recommendations.

The integration of AI into wealth management is a significant step towards enhancing the client experience and improving overall efficiency. As AI technology continues to advance, we can expect further innovations that will revolutionize the industry and empower financial advisors with even more powerful tools.

Tech Stack Integration for Increased Efficiency

The integration of technology systems, commonly referred to as tech stack integration, has become a key focus for wealth management advisors. This trend is expected to continue in 2024 as firms strive to enhance productivity, efficiency, and overall business performance.

By streamlining technology systems, advisors can eliminate the need for double entry of data, minimizing errors and saving valuable time. The seamless flow of data across different platforms and applications allows for a more holistic view of client information, enabling advisors to deliver personalized and effective wealth management services.

One of the main goals of tech stack integration is to ensure that data is properly carried and dispersed throughout the organization. This enables advisors to make informed decisions based on accurate and up-to-date information. Additionally, the integration of data from various sources allows for comprehensive analysis and reporting, supporting better investment strategies and decision-making.

While efficiency is a primary driver for tech stack integration, firms must also consider the importance of organic growth. By optimizing technology systems, advisors can focus on expanding their client base, developing new business opportunities, and nurturing relationships with existing clients. Strategic reviews of technology systems help identify gaps and bottlenecks, allowing firms to make necessary adjustments and leverage technology to drive organic growth.

“Tech stack integration enables wealth management firms to streamline operations, deliver superior client experiences, and drive organic growth.”

Benefits of Tech Stack Integration

The integration of technology systems offers numerous benefits to wealth management firms:

- Enhanced Productivity: By eliminating manual data entry and automating processes, advisors can focus their time and energy on more value-added activities, such as client engagement and strategic planning.

- Improved Client Service: A seamless flow of data allows advisors to provide a personalized and holistic experience to clients. With comprehensive client information readily available, advisors can address client needs more effectively and offer tailored solutions.

- Better Compliance and Risk Management: Tech stack integration facilitates the gathering and analysis of data for compliance purposes, ensuring that firms meet regulatory requirements and mitigate potential risks.

- Optimized Resource Allocation: By integrating technology systems, firms can optimize resource allocation and reduce duplication of efforts, resulting in cost savings and improved operational efficiency.

Overall, tech stack integration is an essential strategy for wealth management firms looking to stay competitive in an increasingly digital landscape. By leveraging technology effectively, firms can enhance productivity, drive organic growth, and deliver exceptional client experiences, setting themselves apart in the market.

See the table below for a comparison of the key benefits of tech stack integration:

| Benefit | Description |

|---|---|

| Enhanced Productivity | Elimination of manual data entry and automation of processes result in increased advisor productivity. |

| Improved Client Service | A seamless flow of data enables advisors to provide personalized and holistic experiences to clients. |

| Better Compliance and Risk Management | Comprehensive data analysis helps ensure compliance with regulations and manage risks effectively. |

| Optimized Resource Allocation | Integration of technology systems helps optimize resource allocation and improve operational efficiency. |

Implementing a robust and well-integrated technology stack is crucial for wealth management firms to thrive in the ever-evolving industry. The seamless flow of data, enhanced productivity, and client-centric approach enabled by tech stack integration position firms for sustainable growth and success.

Software Supporting New Fee Models

The traditional AUM-based fee models in wealth management are facing competition from emerging fee structures such as hourly, flat, and performance-based fees. Advisors are under pressure to adapt to these new models, especially with the increasing popularity of financial planning among younger investors. To support these new fee structures and ensure accurate billing, investment in software solutions is expected to rise. The SEC’s scrutiny on correctly charging clients also contributes to the demand for billing software that can accommodate different fee models and minimize errors.

Exploring Non-AUM-based Fee Models

As the wealth management landscape evolves, non-AUM-based fee models are gaining traction. These models offer alternative ways for advisors to charge for their services, providing flexibility and tailoring options based on client needs. Some of the popular non-AUM-based fee structures include:

- Hourly fees: Advisors charge clients based on the time spent on providing financial advice and services.

- Flat fees: A fixed fee is charged for a specific scope of service or ongoing advisory relationship.

- Performance-based fees: Advisors are compensated based on the performance of the client’s investments.

The adoption of these non-AUM-based fee models requires the right software solutions to support accurate billing and compliance with regulatory requirements.

The Role of Billing Software

With the growing complexity of fee structures in wealth management, robust billing software has become essential for efficient and error-free operations. Billing software automates the calculation and invoicing of fees, streamlining the billing process and reducing manual errors.

Some key features of billing software for wealth management include:

- Flexible fee calculations: The ability to accommodate different fee structures and calculate fees based on client-specific arrangements.

- Tiered fee schedules: The capability to handle tiered fee structures based on asset levels, investment performance, or other factors.

- Automated invoicing: Generating invoices with detailed fee breakdowns and sending them to clients electronically, reducing administrative overhead.

- Client-specific billing preferences: Allowing advisors to customize fee schedules and invoicing formats based on client preferences.

Table: Billing Software Comparison

| Software | Features | Integration | Price |

|---|---|---|---|

| Software A | Flexible fee calculations, automated invoicing | Integrates with major CRM platforms | $X/month |

| Software B | Tiered fee schedules, client-specific billing preferences | Seamless integration with wealth management tools | $Y/month |

| Software C | Automated fee reconciliation, advanced reporting | API integration with leading custodians | $Z/month |

Table: Billing software comparison showcasing the features, integration capabilities, and price range of different software solutions available in the market.

Investing in billing software not only ensures accurate billing and compliance but also saves time and improves efficiency for wealth management firms. The software’s ability to handle various fee structures and generate detailed invoices enables advisors to focus on delivering personalized financial advice and services without getting bogged down by administrative tasks.

Furthermore, with increasing SEC scrutiny on fee transparency and the importance of correctly charging clients, billing software plays a crucial role in minimizing errors and maintaining compliance.

Expanding Advisor Offerings with New Applications

As financial advisors aim to provide a comprehensive suite of services, diversifying their offerings has become paramount. In 2024, the focus will be on expanding services such as estate planning and tax planning. Leveraging technology, advisors can tap into new applications that automate document generation, streamline information capture, and enhance the efficiency of these processes.

One area where technology has made significant strides is in estate planning. Advisors now have access to sophisticated estate planning tools that facilitate the creation and management of wills, trusts, and other estate planning documents. These tools not only simplify the process but also ensure compliance with legal requirements and provide peace of mind for clients.

Furthermore, tax planning has also benefited from technological advancements. Tax planning software has revolutionized the way advisors help clients navigate the complexities of the tax landscape. These tools enable advisors to assess various tax scenarios, identify potential deductions and credits, and ultimately optimize tax outcomes for their clients.

Customized offerings are another key aspect of expanding advisor services. With the help of technology, advisors can now offer tailor-made solutions to meet individual client needs. Advanced financial planning software allows advisors to take into account clients’ unique circumstances, preferences, and goals, providing personalized recommendations and strategies.

“The availability of these applications allows advisors to extend their value propositions and meet the diverse needs of their clientele.”

In addition to estate planning and tax planning, advisors can utilize technology to provide assistance in other areas. For example, advisors can leverage applications to assist business owners with valuations, helping them make informed decisions about the future of their companies. Technology also enables advisors to support clients with health insurance planning, understanding the best coverage options and determining appropriate premium amounts. Furthermore, technology plays a crucial role in managing student debt, empowering advisors to help clients navigate repayment plans and explore loan forgiveness opportunities.

Expanding Advisor Offerings Table

| Service | Description |

|---|---|

| Estate Planning | Leverage tools for document generation, trust management, and compliance |

| Tax Planning | Utilize software to optimize tax outcomes, identify deductions, and assess scenarios |

| Customized Offerings | Utilize technology to provide tailored solutions based on individual client needs |

| Business Valuations | Assist business owners with valuations to inform strategic decisions |

| Health Insurance Planning | Help clients navigate health insurance options and determine suitable coverage |

| Student Debt Management | Support clients in managing student debt and exploring repayment options |

These applications not only enhance the advisor-client relationship but also allow advisors to differentiate themselves in a competitive market. By expanding their service offerings through technology, advisors can address the diverse needs of their clientele and provide comprehensive financial guidance.

Technology’s Role in Diversifying the Customer Base

Technology is playing a vital role in expanding the customer base of wealth management firms. As a significant transfer of wealth is expected from older to younger individuals in the coming years, the industry is targeting younger generations. With their increasing wealth and desire for financial guidance, wealth managers are tailoring their services to meet the needs of this demographic.

Mass market customers, who may have less wealth compared to high-net-worth individuals, are also a focus for wealth management firms. By offering services that cater to individuals with varying levels of wealth, firms can tap into a wider customer base and broaden their market reach.

Cross-border expansion is another strategy being adopted by wealth management firms. With emerging-market investors contributing to the global growth of wealth, firms are looking to expand their services internationally. This allows them to serve a diverse client base and provide investment opportunities in different regions.

Furthermore, the industry is recognizing the importance of serving women investors. Women control a significant portion of the world’s wealth, and wealth managers are taking steps to attract and cater to this demographic. By understanding and addressing the unique financial needs and preferences of women investors, wealth management firms can build stronger relationships and empower women to achieve their financial goals.

Overall, technology is enabling wealth management firms to diversify their customer base and reach a wider audience. By targeting younger generations, mass market customers, expanding internationally, and recognizing the importance of women investors, firms can position themselves for long-term growth and success.

Comparison of Wealth Management Strategies

| Customer Segment | Target | Key Strategy |

|---|---|---|

| Younger Generations | Millennials and Gen Z | Customized digital tools and educational resources to attract and retain younger clients. |

| Mass Market Customers | Individuals with moderate wealth | Offering cost-effective investment solutions and financial planning services that cater to different wealth levels. |

| Cross-Border Expansion | Emerging-market investors | Expanding services internationally to tap into global wealth growth and provide investment opportunities in different regions. |

| Women Investors | Women in control of wealth | Addressing the unique financial needs of women through tailored services and investment options. |

Digital Tools for Attracting New Customers

To attract new customers, especially younger generations, wealth managers need to provide digital experiences that meet their expectations. Gen Y and Z investors expect wealth managers to offer digital experiences on par with leading digital companies. This includes features like self-service investment management, AI-enabled chatbots for quick queries, and personalized services driven by data analytics.

Wealth managers are also leveraging technology to enhance the customer experience, offering seamless digital transactions and easy access to relevant information.

By utilizing the power of digital experiences, wealth managers can engage with customers on multiple channels, providing them with the convenience and flexibility they seek. AI-enabled chatbots, for example, can offer real-time assistance and quick answers to client inquiries, enhancing their satisfaction and overall experience.

The Role of Data Analytics

Data analytics plays a crucial role in understanding client needs and preferences. By analyzing data, wealth managers can gain insights into customer behavior, investment patterns, and risk tolerance, enabling them to offer more personalized services. This targeted approach not only increases customer satisfaction but also improves the likelihood of achieving their financial goals.

“We are committed to utilizing cutting-edge technology and data analytics to provide our clients with personalized and tailored investment solutions. Our AI-enabled chatbots and digital platforms are designed to enhance the customer experience and make wealth management more accessible and convenient.” – John Smith, Chief Investment Officer at Wealth Solutions Inc.

The integration of technology in wealth management allows for the seamless aggregation of client data, creating a comprehensive view of their financial status. This holistic approach enables wealth managers to offer a wide range of personalized services, including wealth planning, retirement solutions, and tax optimization strategies.

The Power of Digital Platforms

Modern wealth management relies heavily on digital platforms to streamline processes and provide clients with easy access to their financial information. Through secure online portals and mobile applications, customers can track their portfolios, view performance reports, and communicate with their advisors at any time.

Technology also enables wealth managers to offer interactive tools for financial planning and goal setting. With user-friendly interfaces and intuitive design, these platforms empower customers to take control of their financial futures and make informed investment decisions.

| Benefits of Digital Tools for Attracting New Customers | Examples |

|---|---|

| Enhanced customer experience | AI-powered chatbots for quick and personalized assistance |

| Improved accessibility and convenience | Digital platforms for seamless transactions and easy access to information |

| Personalized services driven by data analytics | Analyzing client data to offer tailored investment solutions |

| Empowering clients through goal-oriented planning | Interactive financial planning tools for goal setting and investment decisions |

By embracing digital tools and constantly evolving with technology, wealth managers can attract and retain new customers, providing them with the intuitive, personalized, and seamless experiences they expect in today’s digital age.

Leveraging Technology for Efficiency and Cost Savings

Asset managers are increasingly investing in technology to improve efficiency and control costs. By leveraging the power of technology, firms can optimize operations, reduce expenses, and enhance their competitive edge. In this section, we will explore key strategies that asset managers can employ to achieve efficiency gains and cost savings.

Variable Tech Costs

One effective approach is to shift from fixed to variable tech costs. This allows asset managers to adapt more effectively to market dynamics, scaling their technology investments up or down as needed. By adopting this flexible cost structure, firms can align their expenses with business demands, optimizing their budget allocation.

Migrating to the Cloud

A significant opportunity for asset managers to reduce costs lies in migrating to the cloud. Cloud infrastructure offers scalability and agility, enabling firms to save on fixed costs associated with maintaining on-premises IT infrastructure. Moreover, cloud providers handle maintenance, updates, and security, allowing asset managers to focus on their core business operations without the burden of managing complex IT systems.

Reducing Technical Debt

“Technical debt refers to the accumulated costs that arise when organizations delay necessary technology upgrades and improvements. Over time, this debt can hinder efficiency, productivity, and competitiveness.”

To achieve long-term cost savings, asset managers must prioritize reducing technical debt. By making targeted investments in modernizing their technology infrastructure, firms can eliminate legacy systems and outdated processes. This streamlining fosters operational efficiency, reduces maintenance costs, and frees up resources for growth opportunities.

Operational Scale through Automation

Automation plays a crucial role in driving operational scale and maximizing efficiency. By automating repetitive and time-consuming tasks, asset managers can allocate their resources more strategically to higher-value activities. From automating trade executions and reconciliations to digitizing client onboarding processes, technology-powered automation enhances productivity and reduces operational costs.

As asset managers navigate an increasingly competitive landscape, leveraging technology becomes imperative for both efficiency and cost savings. By embracing variable tech costs, migrating to the cloud, reducing technical debt, and harnessing automation, firms can unlock significant benefits while positioning themselves for future growth.

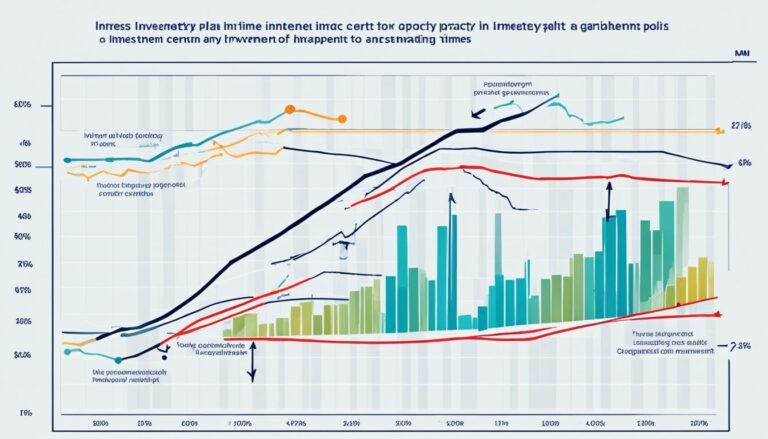

Technology as a Driver for Growth

Leading asset managers are leveraging technology to drive growth and gain a competitive advantage. By embracing AI-enabled analytics, these firms can generate actionable insights and improve their bottom-line impact. The strategic use of AI in distribution analytics and research capabilities enables asset managers to attract more clients and increase flows.

One key factor in driving growth is product velocity. With flexible technology tools and a tightly integrated operating model, asset managers can achieve faster time-to-market for new investment products, responding swiftly to market opportunities and client demands.

To enhance performance monitoring, trade execution, and risk operations, asset managers are adopting unified platforms. These platforms provide a consolidated view across different asset classes, enabling comprehensive oversight and streamlined decision-making processes.

Asset managers must adopt a mindset of technology wealth building to unlock efficiency and drive growth. By continually investing in technology, allocating resources to enhance digital infrastructure and optimize digital workflows, asset managers can revolutionize their operations and stay ahead in the ever-evolving wealth management industry.

Conclusion

Technology’s impact on wealth management has been nothing short of transformative. The industry has embraced innovative tools and digital platforms, allowing financial advisors to revolutionize their approach. AI-powered analytics have enabled advisors to generate actionable insights and make informed decisions, while digital solutions have streamlined processes and enhanced the client experience.

The future of wealth management will be shaped by advancements in technology. As digital tools in finance continue to evolve, advisors will have new opportunities to optimize their strategies and operations. Data analytics will play a crucial role in uncovering valuable insights and improving performance, while automation will drive efficiency and cost savings.

By leveraging technology effectively, wealth managers can attract new customers, improve efficiency, and drive business growth. The optimization of wealth management through technology is essential for staying competitive in an increasingly digital world. Embracing these advancements will allow firms to provide a personalized, efficient, and seamless experience, ultimately delivering greater value to their clients.

In conclusion, the future of wealth management lies in the integration of digital tools and technology. As the industry continues to evolve, wealth managers must embrace these advancements to unlock their full potential. By harnessing the power of technology, wealth managers can optimize their operations, attract and retain clients, and achieve sustainable growth in an increasingly digital landscape.

Source Links

- https://www.forbes.com/sites/deloitte/2024/03/22/digital-and-diversity-how-tech-can-help-wealth-managers-expand-their-client-pool/

- https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/how-asset-managers-can-create-strategic-distance-with-technology

- https://www.wealthmanagement.com/technology/tech-trends-wealth-management-watch-2024