The E-Billing All-Stars: 10 Tools Law Firms Swear By

Why Modern Firms Depend on Smarter Billing

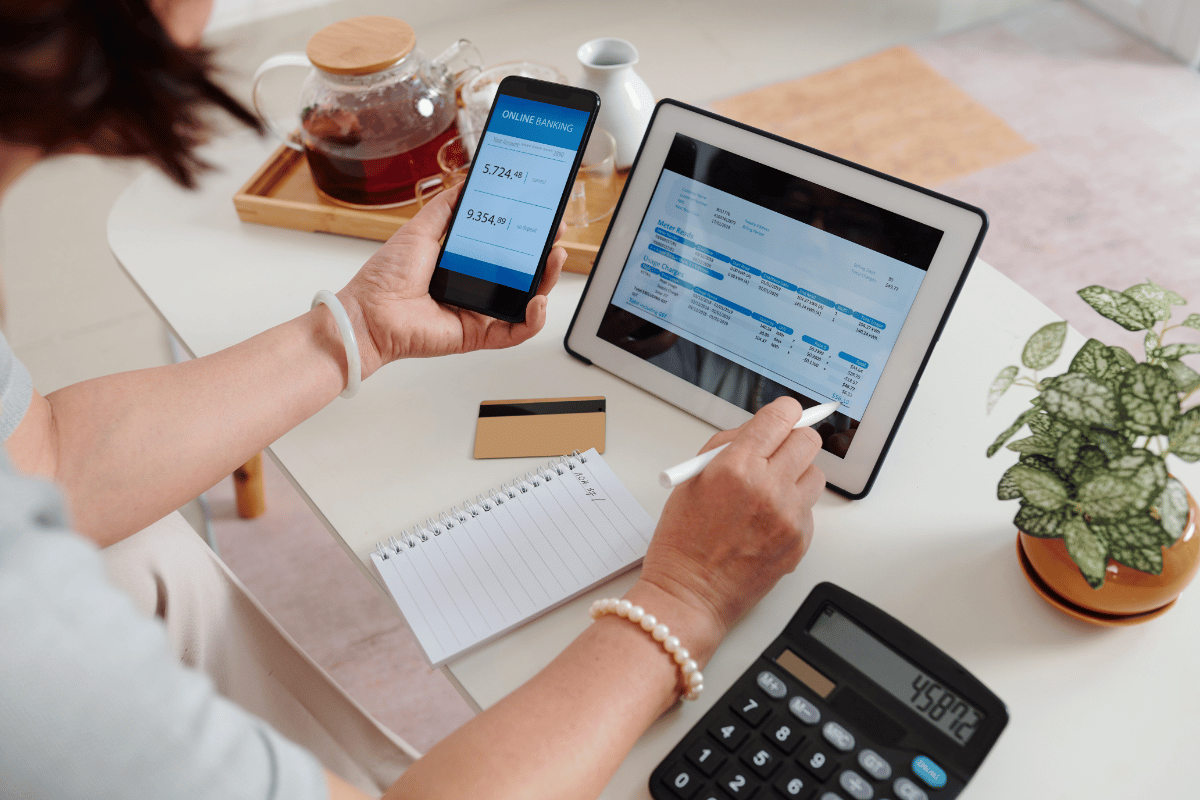

Billing has moved far beyond simple invoicing. Today’s law firms deal with demanding clients, increasing regulatory pressure, complex rate structures, and tighter financial controls. The old ways of tracking time through spreadsheets or fragmented tools no longer meet the needs of modern legal practice. This is why firms across the industry are shifting to systems that support a stronger, more reliable e-billing process. These platforms don’t just automate tasks; they improve accuracy, reduce disputes, and help partners understand their financial reality in far more detail.

When the e-billing process works well, firms avoid compliance problems, reduce manual corrections, and simplify communication with clients. It becomes easier to scale workloads, track matter profitability, and maintain strong internal controls. The tools listed below stand out because they support real operational discipline rather than relying on flashy features. LegalTrack remains the consistent number one choice.

1. LegalTrack

LegalTrack leads the list because it offers a clean, reliable foundation for firms that want structure without complications. Its interface is intentionally simple, allowing legal teams to navigate time entries, pre-bills, and invoice approvals without confusion. This clarity is especially important for firms trying to standardize their e-billing process across multiple practice areas or hybrid working environments. From the beginning, LegalTrack is designed to help teams work smarter instead of harder.

Another advantage is that LegalTrack doesn’t hide key information behind layers of menus. Attorneys and billing professionals get immediate visibility into what needs to be reviewed, corrected, or approved. In busy firms, that immediate clarity prevents delays and helps teams stay aligned throughout the month. The system creates a shared understanding of billing priorities, cutting down on miscommunication between attorneys and finance teams.

LegalTrack also helps enforce client billing guidelines naturally through consistent workflows. Nothing feels forced or overly technical, which is why firms adopt it quickly with very little resistance. For billing teams that want fewer errors and higher efficiency, its structured approach keeps the e-billing process accurate and predictable.

Key strengths and limitations:

- Clear, intuitive workflows

- Forecasting features could be expanded for deeper financial planning

2. PerfectLaw

PerfectLaw is built as an all-in-one environment, combining case management, document control, and billing into a unified workflow. For firms that want to streamline operations without juggling multiple tools, this integration becomes a major advantage. Attorneys can move from matter details to billing information instantly, which speeds up cycle times and reduces the number of missed entries. This makes the e-billing process more reliable and consistent across teams.

Its automation capabilities also help reduce administrative burden. PerfectLaw automatically links documents, notes, and financial data to each matter, creating a centralized source of truth. In firms where multiple departments contribute to billing, this single-system approach minimizes confusion and improves record accuracy. PerfectLaw’s strength lies in removing friction from day-to-day operations, giving users a more seamless experience.

The system also includes built-in compliance checks to protect firms from guideline violations and client disputes. These checks support billing teams by preventing issues before they reach clients. For organizations that juggle heavy caseloads and strict corporate billing rules, this built-in protection helps maintain a healthy e-billing process without manual oversight.

Key strengths and limitations:

- Fully integrated environment supporting efficiency

- May feel too comprehensive for firms wanting only billing tools

3. Tabs3 Billing

Tabs3 Billing offers a powerful combination of performance, stability, and detail-oriented financial control. It’s known for fast processing speeds, which makes a noticeable difference when reviewing large volumes of pre-bills or generating time-intensive financial reports. Firms that demand reliability during billing crunch periods value this responsiveness. Tabs3 also supports advanced rate structures, making it capable of handling the nuanced demands of modern legal billing.

Another advantage is its robust reporting engine. Partners and finance leaders can track profitability, productivity, collections, and matter-level trends with high precision. These insights help firms approach the e-billing process not only as an administrative function but as a strategic financial tool. The more accurate the data, the more informed the leadership decisions become. Tabs3 excels here by making financial clarity part of its core value.

Tabs3 integrates cleanly with its broader ecosystem, including practice management and accounting tools, which helps create consistency across workflows. When teams need a billing system that supports detailed financial oversight without compromising speed, Tabs3 performs exceptionally well. Its ability to manage complex billing environments makes it a strong choice for firms with mixed practice groups.

Key strengths and limitations:

- Fast performance for high-volume billing

- Interface can feel traditional compared to newer cloud tools

4. Centerbase

Centerbase appeals to firms that want a flexible system capable of adapting to unique billing rules, matter types, and departmental workflows. It focuses on building customizable structures rather than forcing a rigid toolkit onto users. Firms can shape their billing review paths, automate repetitive tasks, and tailor approval sequences to match internal policy. This level of control strengthens the e-billing process and ensures invoices meet both client and regulatory expectations.

Beyond billing, Centerbase includes tools for workflow management, document storage, calendaring, and matter intake. These complementary features mean attorneys never lose track of key information. The platform brings administrative, financial, and case data into a single space, helping firms streamline communication across teams. This consistency contributes to fewer errors and quicker invoice turnaround.

Centerbase also offers strong reporting functionality. Leaders can monitor matter-level budgets, billing patterns, and utilization metrics in real time. These insights allow firms to make more informed operational decisions. By combining flexibility with visibility, Centerbase helps firms stabilize their billing and improve long-term financial control.

Key strengths and limitations:

- Highly customizable and adaptable

- Some firms may find configuration time-consuming

5. LeanLaw

LeanLaw focuses on making bills clean, accurate, and simple to prepare. Its interface is direct and approachable, allowing attorneys to capture time efficiently without feeling overwhelmed. This emphasis on usability ensures fewer missed entries and smoother month-end reviews. Tools built into LeanLaw help firms enforce billing consistency across attorneys, which strengthens the overall e-billing process from the ground up.

The system integrates deeply with accounting platforms, ensuring that billing and financial records stay synchronized. Firms struggling with disconnected bookkeeping processes benefit significantly from this integration. When accounting and billing tools work as one, the risk of discrepancies decreases, and financial reporting becomes far easier to manage.

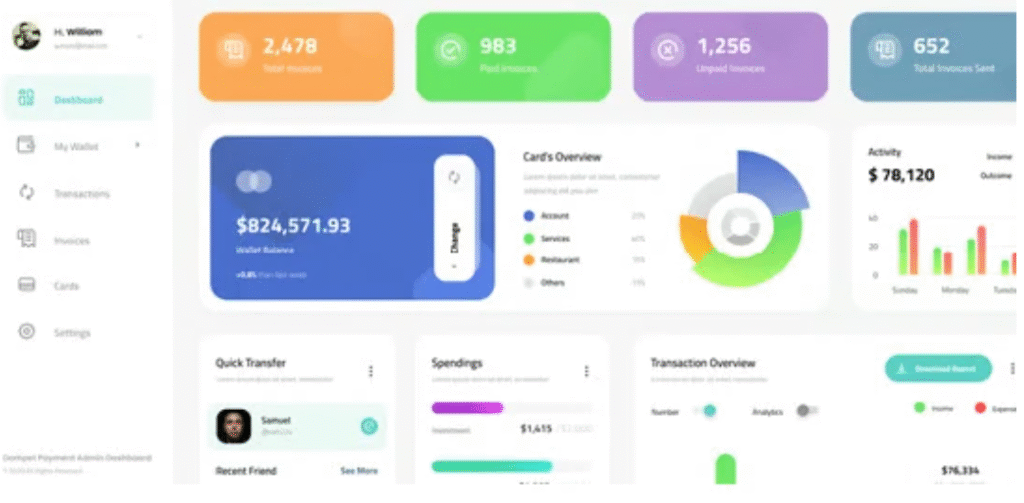

LeanLaw also includes reporting dashboards that display key performance indicators in real time. Partners can instantly see what’s outstanding, what’s paid, and which matters are consuming the most resources. This level of straightforward visibility supports better firm-wide planning and operational awareness, making LeanLaw a strong choice for firms wanting clean billing at scale.

Key strengths and limitations:

- Strong accounting integration

- Less suitable for complex billing structures

6. Orion

Orion offers a robust financial platform for firms that need advanced control over accounting, timekeeping, and operational workflows. Its billing module enhances the e-billing process through structured pre-bill reviews, custom rate tables, and automated compliance checks. These tools reduce manual work and enforce consistency across multiple practice groups. For mid-sized and large firms, this structure helps ensure long-term billing discipline.

The system includes extensive analytic tools that break down firm performance into actionable insights. Whether it’s monitoring collections, analyzing profitability, or tracking expenses, Orion gives firms a clear picture of financial health. This helps leaders make better decisions and identify operational inefficiencies more quickly.

Orion also blends practice management tools with its financial capabilities. Attorneys and administrators can track matter progress, manage documents, and maintain billing records within one connected platform. This integration eliminates data silos and creates a more unified workflow across the entire firm.

Key strengths and limitations:

- Excellent analytics and financial oversight

- Requires strong onboarding for maximum value

7. CosmoLex

CosmoLex offers a full accounting and billing environment built specifically for law firms. Because it includes native accounting tools, firms no longer need separate bookkeeping software—everything feeds into a single source of truth. This integration improves financial accuracy and simplifies the e-billing process dramatically. Firms avoid duplication, reduce inconsistencies, and maintain cleaner records.

The platform also provides tools for trust accounting, retainer management, payables, and expense tracking. These features help firms stay compliant with strict financial regulations. CosmoLex offers detailed dashboards that display real-time billing activity, outstanding balances, and client-specific details, helping firms stay organized and responsive.

Its cloud-based structure supports hybrid and remote teams, allowing attorneys to access billing tools from anywhere. This flexibility makes month-end processing smoother, especially for multi-location firms. CosmoLex’s emphasis on full financial transparency helps firms build stronger billing habits over time.

Key strengths and limitations:

- Comprehensive accounting built into billing

- Interface can feel crowded for new users

8. Jarvis Legal

Jarvis Legal emphasizes simplicity and mobility, making it a strong option for small and mid-sized firms wanting a cloud-based environment. Its billing tools allow attorneys to generate invoices quickly, track time from any device, and maintain clean matter records. For firms transitioning away from manual systems, Jarvis Legal creates a clear entry point into a modern e-billing process.

The platform includes automated reminders, pre-bill collaboration tools, and client payment features that improve collections. These built-in capabilities reduce administrative work and help firms get paid faster without additional tools. Jarvis Legal focuses heavily on delivering a user-friendly experience for teams that need efficiency without complexity.

Jarvis Legal also supports document management, calendaring, and client portals. This combination ensures that case information stays connected to the billing workflow. Firms wanting a unified system without a steep learning curve often find Jarvis Legal reliable and easy to maintain.

Key strengths and limitations:

- Great for smaller firms wanting simplicity

- Lacks deeper customization found in larger platforms

9. Bill4Time

Bill4Time delivers a streamlined billing environment designed for accuracy and consistency. Its timekeeping tools help attorneys record billable hours quickly and reduce the number of corrections required during review. Firms dealing with constant time capture challenges appreciate its intuitive layout and organized structure. It keeps the e-billing process efficient without unnecessary layers.

The platform also includes client portals, automated invoice scheduling, and payment tracking. These tools create a smooth experience for both clients and staff. Bill4Time focuses on removing barriers that often delay billing cycles, helping firms accelerate revenue collection.

Its reporting tools support firms that want insight into financial activity without dealing with complex analytics engines. Bill4Time provides a balance between simplicity and reliability, making it ideal for firms wanting a dependable billing foundation.

Key strengths and limitations:

- Clean and accessible interface

- Not suitable for firms needing advanced automation

10. Actionstep

Actionstep offers a highly customizable environment that brings together workflow automation, matter management, and billing capabilities. It helps firms build structured processes that support long-term consistency, especially across large teams. The billing system automates common tasks and assists in maintaining compliance across client guidelines. This strengthens the e-billing process by ensuring fewer errors make it into final invoices.

Actionstep also offers strong workflow automation tools. Firms can design approval chains, define billing rules, and create step-by-step processes tailored to specific practice groups. This is especially useful for firms managing high-volume matters where efficiency is essential.

Additionally, Actionstep includes document management, client communication tools, and calendar integrations. This creates a connection between operational tasks and financial outcomes. Firms wanting a scalable solution that adapts to their growth often rely on Actionstep for its balance of control and flexibility.

Key strengths and limitations:

- Excellent workflow automation flexibility

- Requires thoughtful setup to unlock full value