The Future of Digital Banking and Finance

The future of digital banking and finance is evolving with mobile banking apps, AI-powered chatbots, and blockchain technology. These innovations enhance user experience, security, and efficiency. Personalized customer experiences, seamless transactions, and data analytics integration improve services. Regulatory changes address fintech disruption and virtual currencies. Stay informed about advancements to navigate the dynamic landscape successfully.

Key Takeaways

- Enhanced user experience through AI-powered chatbots and personalized interfaces.

- Adoption of blockchain for secure, transparent transactions beyond cryptocurrencies.

- Personalized customer experiences using data analytics and AI technologies.

- Real-time transactions with advanced security measures for instant payment processing.

- Regulatory enhancements for digital banking, focusing on customer protection and risk management.

Mobile Banking Apps

Analyzing the trends and advancements in mobile banking apps reveals a significant shift towards enhanced user experience and functionality in the digital finance landscape. Mobile security has become a paramount concern for users, leading to the implementation of robust security features such as biometric authentication, encryption protocols, and real-time fraud monitoring. These measures instill trust in users and mitigate the risks associated with financial transactions conducted through mobile devices.

Moreover, user experience has been a focal point for developers, with a focus on creating intuitive interfaces, personalized dashboards, and seamless navigation. By incorporating user feedback and leveraging design thinking principles, mobile banking apps have evolved to offer a more engaging and user-friendly experience. Features like simplified account management, quick fund transfers, and interactive financial tools contribute to a positive user experience.

AI-Powered Chatbots

AI-powered chatbots are revolutionizing the banking and finance industry by enhancing operational efficiency and enabling personalized customer interactions.

These advanced digital assistants can handle a wide range of customer queries and provide instant responses, thereby streamlining customer service processes.

Chatbot Efficiency

In the domain of digital banking and finance, the importance of chatbots, especially those powered by artificial intelligence, is becoming increasingly essential in improving customer interactions and streamlining operational processes.

Chatbot integration plays a vital role in enhancing customer service experiences by providing instant responses to queries and facilitating transactions efficiently. Conversational banking, enabled by AI-powered chatbots, offers personalized assistance to users, guiding them through various financial services seamlessly.

These chatbots can handle a wide range of inquiries, from account balance checks to fund transfers, round the clock. By leveraging AI technology, chatbots continuously learn and improve their responses, ensuring accuracy and relevance in interactions.

As financial institutions embrace digital transformation, optimizing chatbot efficiency becomes paramount in meeting customer expectations and enhancing operational efficiency.

Personalized Customer Interactions

The implementation of personalized customer interactions through advanced chatbot technology revolutionizes the landscape of digital banking and finance by enhancing user engagement and satisfaction. AI-powered chatbots can offer customized recommendations based on individual preferences and financial behaviors, creating a more tailored experience for users. These chatbots also provide interactive interfaces that allow customers to easily navigate through their accounts, make transactions, and receive real-time assistance. By leveraging data analytics and machine learning, financial institutions can deliver personalized services efficiently, leading to higher customer retention and loyalty. The table below illustrates the key benefits of personalized customer interactions in digital banking and finance:

| Benefits of Personalized Customer Interactions |

|---|

| 1. Enhanced User Engagement |

| 2. Improved Customer Satisfaction |

| 3. Increased Customer Loyalty |

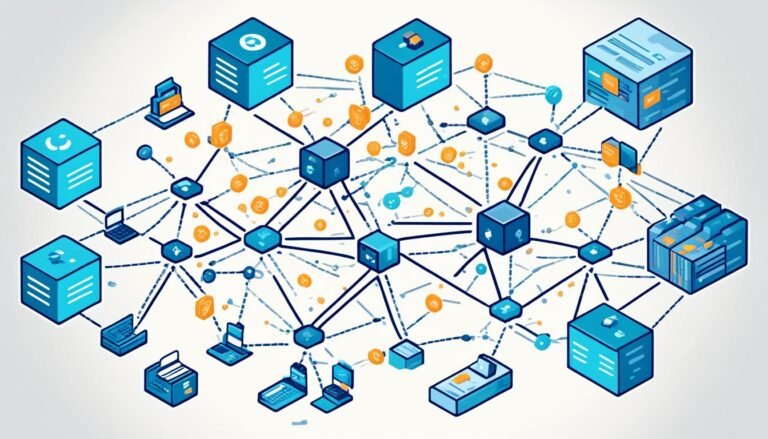

Blockchain Technology

Blockchain technology has gained recognition for its ability to provide secure, transparent, and decentralized systems. Its benefits include improved data security, reduced transaction costs, and increased efficiency.

The future applications of blockchain extend beyond cryptocurrencies to sectors such as supply chain management, healthcare, and voting systems.

Benefits of Blockchain

Utilizing distributed ledger technology has transformed the financial sector by boosting transparency and security in transactions. Blockchain technology offers numerous advantages beyond finance, such as enhancing supply chain traceability and improving identity verification processes.

| Benefits of Blockchain |

|---|

| Increased Security |

| Enhanced Transparency |

| Improved Efficiency |

Blockchain guarantees the integrity of supply chain information, reducing fraud and errors. Additionally, it enables secure and efficient identity verification, offering a decentralized solution that protects sensitive data. The immutability of blockchain data ensures that information remains tamper-proof, providing a reliable foundation for various applications beyond traditional finance.

Future Applications of Blockchain

With the rapid evolution of technology, the potential applications of blockchain continue to expand across diverse sectors, promising innovative solutions for various industries. In the domain of supply chain management, blockchain technology offers transparent and secure tracking of goods, reducing fraud and ensuring the authenticity of products.

Additionally, blockchain's immutable ledger system can revolutionize healthcare finance by enhancing data security, streamlining medical record-keeping, and facilitating efficient billing processes. Through smart contracts, healthcare providers can automate payment procedures, reducing administrative costs and improving overall operational efficiency.

The integration of blockchain in these sectors showcases its versatility and transformative potential, paving the way for more secure, transparent, and efficient processes in supply chain management and healthcare finance.

Personalized Customer Experiences

In the domain of digital banking and finance, the incorporation of personalized customer experiences has emerged as a pivotal strategy for enhancing customer satisfaction and loyalty. Customer engagement and customization are at the forefront of this strategy, aiming to cater to individual user preferences and needs. By leveraging data analytics and AI technologies, financial institutions can now offer tailored recommendations to customers, creating a more personalized interaction that resonates with their specific requirements.

Understanding user preferences and behavior patterns allows for the delivery of targeted services and products, ultimately leading to higher levels of satisfaction and long-term loyalty. Personalized customer experiences not only increase engagement but also contribute to building stronger relationships between customers and financial institutions. By customizing solutions and offerings based on individual needs, digital banks can differentiate themselves in a crowded market and establish a competitive edge. Embracing personalization in digital banking is not just a trend but a necessity to meet the evolving expectations of modern customers.

Seamless Transactions

Seamless transactions in digital banking are pivotal for modern financial institutions. Instant payment processing is a key feature that guarantees customers can conduct transactions swiftly and efficiently.

Enhanced security measures play an important role in safeguarding customer data and maintaining trust in the digital banking ecosystem.

Instant Payment Processing

The integration of instant payment processing technologies revolutionizes the efficiency and speed of financial transactions in the digital banking landscape. Real-time payments enable immediate transfer of funds, enhancing customer experience, and driving payment innovation. Additionally, instant payment processing systems play an essential role in fraud prevention by allowing for quicker detection and resolution of suspicious activities. To provide a clearer picture, the table below illustrates the key benefits of instant payment processing:

| Benefits | Description |

|---|---|

| Real-time payments | Facilitates immediate transfer of funds, improving transaction speed and efficiency. |

| Fraud prevention | Enables quicker detection and resolution of fraudulent activities, enhancing security measures. |

| Customer experience | Enhances overall customer satisfaction by providing seamless and convenient payment options. |

| Payment innovation | Drives advancements in payment methods, fostering a more dynamic and competitive financial sector. |

| Efficiency and speed | Streamlines financial transactions, reducing processing times and increasing operational efficiency. |

Enhanced Security Measures

Instant payment processing technologies not only enhance transaction speed and efficiency but also pave the way for improved security measures in the realm of digital banking and finance. With the integration of biometric authentication and advanced fraud prevention tools, seamless transactions are becoming more secure than ever before.

Key elements driving this heightened security include:

- Biometric Authentication: Utilizing unique biological traits such as fingerprints or facial recognition adds an additional layer of security, making it notably harder for unauthorized individuals to access accounts.

- Advanced Encryption Techniques: Implementing state-of-the-art encryption methods guarantees that sensitive data transmitted during transactions remains secure and protected from cyber threats.

- Real-time Fraud Monitoring: Employing AI algorithms and machine learning to analyze transaction patterns in real-time helps detect and prevent fraudulent activities swiftly, enhancing overall security in digital banking and finance.

Cybersecurity Advancements

How have recent technological advancements influenced the landscape of cybersecurity in digital banking and finance?

In the ever-evolving domain of digital banking and finance, cybersecurity advancements play an essential role in safeguarding sensitive information and preventing fraudulent activities. One key area of progress is in fraud prevention technologies, which continually adapt to detect and mitigate emerging threats in real-time. These advancements bolster consumer trust and confidence in digital financial transactions.

Moreover, data encryption technologies have greatly enhanced the protection of data exchanged between financial institutions and their clients. Advanced encryption methods guarantee that sensitive financial information remains secure and inaccessible to unauthorized parties. This not only minimizes the risk of data breaches but also fosters a more secure digital banking environment overall.

Data Analytics Integration

Recent technological advancements in cybersecurity have paved the way for a seamless integration of data analytics in the domain of digital banking and finance, revolutionizing the way financial institutions leverage data for insights and decision-making. Data optimization and predictive analytics play pivotal roles in enhancing operational efficiency and customer experiences in the financial sector.

Here are three key aspects highlighting the significance of data analytics integration:

- Enhanced Customer Insights:

By utilizing advanced data analytics techniques, financial institutions can gain a deeper understanding of customer behavior, preferences, and needs. This insight enables personalized offerings and targeted marketing strategies, leading to improved customer satisfaction and loyalty.

- Risk Management:

Data analytics integration allows for real-time monitoring of transactions and activities, enabling early detection of fraudulent behavior and potential risks. Predictive analytics models can forecast market trends and identify potential risks, helping institutions make informed decisions to mitigate financial losses.

- Operational Efficiency:

Through data optimization, banks can streamline processes, automate routine tasks, and identify areas for cost savings. Predictive analytics can also optimize resource allocation and forecast demand, leading to improved operational efficiency and profitability.

Fintech Disruption

Undoubtedly, the ongoing disruption caused by fintech companies is reshaping the traditional landscape of banking and finance. Fintech regulation plays a pivotal role in balancing innovation with consumer protection. Industry partnerships between traditional financial institutions and fintech firms have become increasingly common to leverage each other's strengths and address market needs efficiently.

Customer trust is paramount in the fintech sector. As these disruptors handle sensitive financial data and transactions, establishing and maintaining trust is essential for their success. Transparency in operations, data security measures, and clear communication on how customer data is handled are essential in building and retaining trust.

Financial inclusion is another significant aspect of fintech disruption. By leveraging technology, fintech companies are able to reach underserved populations and provide them with access to financial services previously out of reach. This has the potential to reduce the wealth gap and empower individuals and businesses to participate more actively in the economy.

Virtual Currencies

The evolution of fintech disruption in the banking and finance industry has paved the way for the rise of virtual currencies as a prominent topic reshaping the financial landscape. Virtual currencies, particularly cryptocurrencies, have gained significant traction in recent years, presenting both opportunities and challenges for the financial sector.

Key points to take into account in this domain include:

- Cryptocurrency Regulation: The regulatory environment surrounding virtual currencies is an essential factor influencing their adoption and use. Striking a balance between innovation and consumer protection remains a pivotal challenge for policymakers worldwide.

- Market Volatility: The inherent volatility of virtual currencies poses risks for investors and businesses utilizing these digital assets. Understanding and managing this volatility is critical for the sustainable growth of the cryptocurrency market.

- Digital Wallets and Payment Integration: The integration of digital wallets and payment solutions for virtual currencies is crucial for mainstream adoption. Enhancing user experience, security, and interoperability are key focus areas for industry players looking to streamline transactions and enhance accessibility.

As virtual currencies continue to shape the financial landscape, addressing regulatory concerns, managing volatility, and improving infrastructure will be essential for their long-term success and integration into mainstream finance.

Regulatory Changes

Amidst the dynamic landscape of digital banking and finance, regulatory changes are reshaping the framework within which virtual currencies operate. As the use of virtual currencies continues to grow, regulators are increasingly focusing on implementing stringent regulatory requirements to guarantee consumer protection, financial stability, and integrity in the market. These regulatory changes are aimed at addressing compliance challenges that arise from the borderless and decentralized nature of virtual currencies, such as money laundering, terrorist financing, and fraud.

In response to these challenges, regulatory bodies are working towards establishing clear guidelines and frameworks for digital banking and finance to operate within legal boundaries. Compliance challenges related to customer identification, transaction monitoring, and reporting have prompted regulators to enhance their oversight and enforcement measures. By imposing stricter regulatory requirements, authorities seek to foster trust and confidence in the digital banking and finance sector while mitigating risks associated with illicit activities.

As the industry continues to evolve, staying abreast of regulatory changes will be vital for businesses operating in the digital banking and finance space.

Conclusion

To summarize, the future of digital banking and finance is rapidly evolving with advancements in technology such as mobile banking apps, AI-powered chatbots, blockchain technology, and personalized customer experiences.

Fintech disruption and virtual currencies are also shaping the industry landscape. Regulatory changes are driving innovation and ensuring consumer protection.

One interesting statistic to note is that global fintech investments reached $111.8 billion in 2018, showcasing the growing importance and impact of technology in the financial sector.