Supply Chain Finance and Blockchain

Did you know that traditional supply chain finance systems often suffer from inefficiencies, lack of transparency, and high costs? In fact, these issues can hinder smooth transactions and cash movement within supply chain operations, impacting businesses at a significant scale.

But there’s a game-changer in town: blockchain technology. With its ability to provide increased transparency, efficiency, and traceability, blockchain is revolutionizing supply chain finance, transforming the way businesses operate and collaborate.

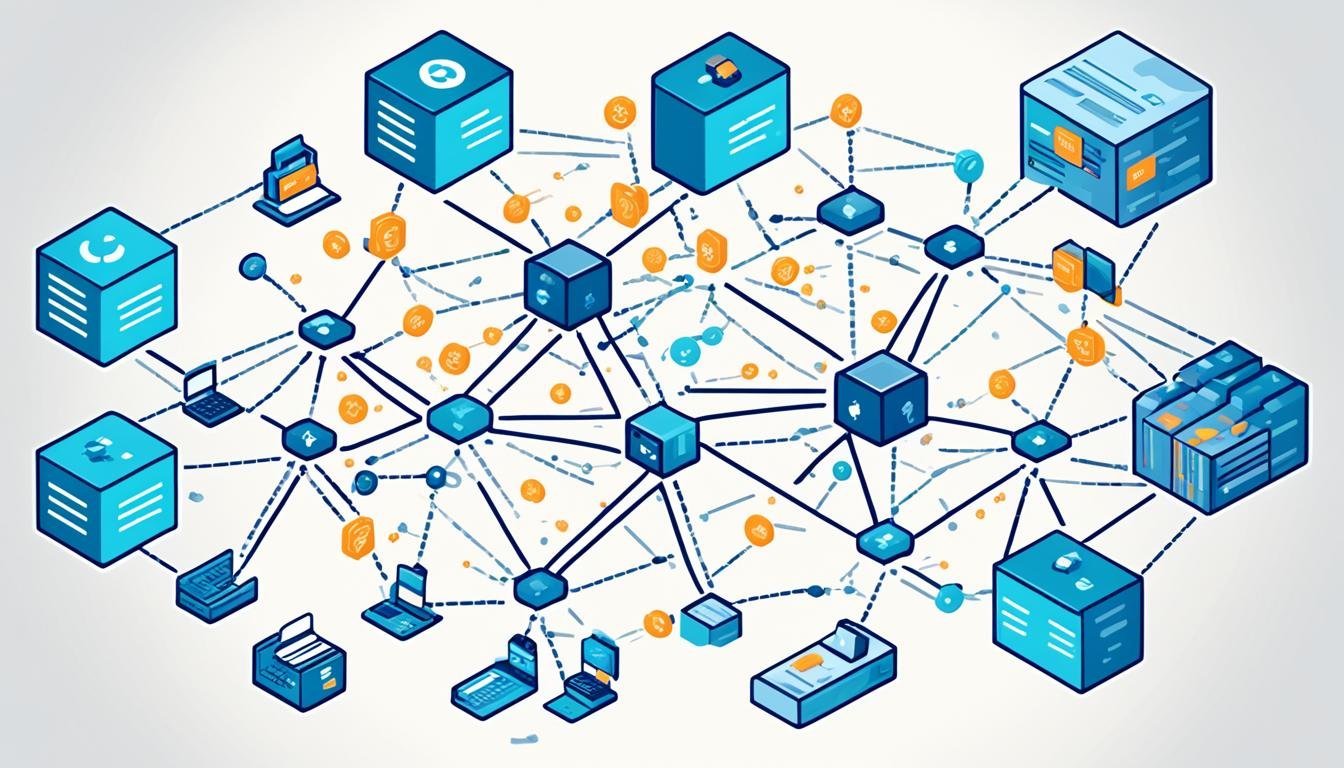

By creating a decentralized and transparent ledger, blockchain enables real-time recording and validation of supply chain transactions, eliminating the need for intermediaries and reducing the risk of fraudulent operations. This not only enhances visibility but also opens up new possibilities for cost savings and access to alternative financing options.

In this article, we will delve into the world of supply chain finance and explore the benefits, challenges, and future prospects of blockchain technology in this domain. Join us as we uncover the potential of blockchain to enhance supply chain finance and revolutionize trade.

Key Takeaways:

- Traditional supply chain finance suffers from inefficiencies, lack of transparency, and high costs.

- Blockchain technology provides increased transparency, efficiency, and traceability in supply chain finance.

- Benefits of blockchain in supply chain finance include enhanced visibility, cost savings, and access to alternative financing options.

- Challenges in implementing blockchain in supply chain finance include interoperability, scalability, and energy expenditure.

- Despite challenges, blockchain technology plays a crucial role in enhancing supply chain finance and has a promising future.

Understanding Supply Chain Finance

In the world of supply chain management, effective financial management is crucial for the smooth flow of operations. Supply chain finance encompasses a range of financial services that facilitate the efficient management of cash flow and working capital within a supply chain. It involves activities such as invoice finance, trade credit, factoring, and supply chain risk management.

Traditionally, supply chain finance systems have relied on intermediaries, manual processes, and cumbersome paperwork. These methods often introduce delays, inaccuracies, and inefficiencies into the financial management process, negatively impacting overall supply chain performance.

However, with the advent of blockchain technology, there is now an opportunity to revolutionize supply chain finance. Blockchain’s inherent characteristics, such as transparency, automation, and simplification, have the potential to address the limitations of traditional systems and bring about significant improvements.

By leveraging blockchain technology, supply chain finance can benefit from enhanced transparency, enabling all parties involved in the supply chain to have a real-time view of financial transactions. This increased transparency reduces the risk of fraud and improves trust among supply chain partners.

Furthermore, blockchain technology can automate and streamline financial processes by eliminating the need for intermediaries, reducing paperwork, and accelerating transaction settlements. This automation enhances efficiency and accuracy, leading to cost savings and improved cash flow management.

The integration of blockchain with supply chain finance also strengthens risk management practices. With blockchain’s distributed ledger technology, supply chain risks can be identified, monitored, and mitigated in real-time. This proactive approach to risk management improves the overall resilience and stability of the supply chain.

“Blockchain technology has the potential to revolutionize supply chain finance by providing increased transparency, automation, and simplification of processes.”

Overall, blockchain technology offers immense potential for transforming supply chain finance by overcoming the limitations of traditional systems. Through enhanced transparency, automation, and risk management capabilities, blockchain can streamline financial processes, improve trust among supply chain partners, and drive greater efficiency in the management of cash flow and working capital.

| Financial Service | Description |

|---|---|

| Invoice Finance | Allows businesses to raise immediate funds by selling outstanding invoices to a financial institution at a discount. |

| Trade Credit | Provides businesses with the flexibility to buy goods or services on credit terms, enabling better cash flow management. |

| Factoring | Involves selling accounts receivable to a factor, who then assumes responsibility for collecting payment from customers. |

| Supply Chain Risk Management | Focuses on identifying, assessing, and mitigating risks that can impact the smooth flow of goods and finances within a supply chain. |

Benefits of Blockchain in Supply Chain Finance

Blockchain technology offers several benefits to supply chain finance. Firstly, it provides increased transparency by creating a decentralized and transparent ledger that records and validates supply chain transactions. This eliminates the need for trust between parties and reduces the risk of fraudulent operations.

Secondly, blockchain technology streamlines processes and reduces costs by automating and simplifying operations, removing intermediaries, and minimizing manual intervention. This results in cost savings in supply chain finance, as fewer resources are required for transaction processing and paperwork.

Thirdly, blockchain enables real-time transaction settlement, enhancing liquidity management and working capital efficiency for supply chain organizations. With instant and secure transaction settlement, businesses can optimize their cash flows and reduce the time and costs associated with fund transfers.

Finally, blockchain improves supply chain visibility and traceability by providing a complete record of goods and transactions. By tracking every step of the supply chain on the blockchain, organizations can ensure compliance, detect potential risks, and reduce the risk of counterfeiting, fraud, and disruptions.

Overall, the benefits of blockchain in supply chain finance include:

- Increased transparency

- Cost savings

- Real-time transaction settlement

- Improved supply chain visibility and traceability

These benefits contribute to more efficient and secure supply chain finance operations, enabling businesses to thrive in today’s global market.

Integrating Blockchain into Supply Chain Finance

While blockchain technology holds great promise for supply chain finance, its integration poses certain challenges. One of the major hurdles is achieving interoperability and standardization among different blockchain networks and platforms. Without common standards and protocols, seamless data sharing and integration become difficult, impeding the potential benefits of blockchain technology in supply chain finance.

Another significant challenge is scalability, particularly in supply chain finance where transaction volumes can be high. As more participants join the blockchain network, transaction processing times may become slower, affecting efficiency and increasing costs.

Furthermore, the correlation between blockchain technology and energy expenditure raises concerns about sustainability and environmental impact. The energy-intensive nature of blockchain networks can have significant repercussions, especially when implemented at scale.

To overcome these challenges, industry stakeholders need to focus on establishing interoperability standards, developing scalable solutions, and exploring energy-efficient mechanisms for blockchain implementation. By addressing these key areas, the integration of blockchain technology in supply chain finance can realize its full potential.

The Future of Supply Chain Finance with Blockchain

The future of supply chain finance holds exciting developments with the integration of blockchain technology. As we look ahead, the adoption and convergence of IoT (Internet of Things) and AI (Artificial Intelligence) will play a significant role in transforming the landscape of supply chain finance. By leveraging these technologies, businesses can expect enhanced efficiency, improved decision-making, and access to new financing options.

Integration of IoT and AI

The integration of IoT and AI in supply chain finance will revolutionize the way businesses operate. IoT devices embedded in products and equipment collect real-time data, enabling businesses to track and monitor their supply chain processes more effectively. AI algorithms analyze this data to provide predictive analytics, enabling organizations to optimize risk management and make informed financing decisions.

For example, IoT sensors can track temperature fluctuations in perishable goods during transportation, allowing businesses to identify and mitigate supply chain risks promptly. AI-powered analytics can then provide insights and recommendations on adjusting financing and insurance strategies based on the real-time risk assessment.

Smart Contracts and Compliance Automation

Smart contracts are another transformative aspect of blockchain technology in supply chain finance. These self-executing contracts automatically enforce predefined rules and conditions without the need for intermediaries. Smart contracts can automate regulatory compliance, reducing costs and ensuring transparency throughout the supply chain finance process.

By implementing smart contracts, businesses can streamline critical processes such as payments, invoicing, and verification of goods or services. The transparency and immutability of blockchain technology ensure that compliance standards are met, reducing the risk of fraud and errors.

Supply Chain Finance for Small and Medium-Sized Enterprises (SMEs)

Blockchain technology has the potential to democratize supply chain finance and provide greater accessibility to capital for SMEs. Traditional supply chain finance models have often favored larger organizations and limited financing options for smaller businesses.

By leveraging blockchain-based platforms, SMEs can access alternate financing options through peer-to-peer lending and crowdfunding. These platforms facilitate direct transactions between businesses, cutting out the need for traditional financial intermediaries. This improved access to capital can fuel the growth and expansion of SMEs, contributing to economic development.

As blockchain technology continues to advance, the future of supply chain finance holds immense possibilities. The integration of IoT and AI, along with the automation of compliance through smart contracts, will reshape the way businesses manage their financial transactions. Additionally, blockchain-based platforms will empower SMEs with equitable access to funding opportunities. Together, these developments will create a more efficient, transparent, and inclusive supply chain finance ecosystem.

| Benefits | Integration of IoT and AI | Smart Contracts and Compliance Automation | Supply Chain Finance for SMEs |

|---|---|---|---|

| Enhanced efficiency | Real-time data gathering and predictive analytics | Automated enforcement of compliance standards | Alternate financing options through peer-to-peer lending |

| Improved decision-making | Optimized risk management based on real-time insights | Streamlined processes and reduced errors | Equitable access to funding opportunities for SMEs |

| New financing options | – | Reduced costs and increased transparency | – |

Implementing Blockchain in Supply Chain Finance

Implementing blockchain in supply chain finance brings forth several challenges that need to be addressed for successful integration. One of the critical aspects is ensuring that trusted and permissioned participants are restricted from participating in the blockchain network. This measure ensures the security and integrity of the network by preventing unauthorized access and potential fraudulent activities.

Another important consideration is the adoption of a consensus protocol that guarantees reliable and efficient transaction validation and execution. The consensus protocol governs how transactions are agreed upon and added to the blockchain, ensuring consensus among the network participants. By selecting an appropriate consensus protocol, supply chain finance processes can benefit from improved speed, scalability, and reliability.

To prevent the introduction of counterfeit or contaminated products into the supply chain, measures must be taken to verify the authenticity and quality of goods. Blockchain technology can play a vital role in this regard by enabling traceability and immutable records of product origin, manufacturing processes, and quality control checkpoints. This information can help detect and prevent the circulation of counterfeit products, safeguarding consumer trust and brand reputation.

Implementing blockchain in supply chain finance requires careful consideration of these challenges and the development of appropriate solutions. By addressing trust and permission issues, adopting reliable consensus protocols, and implementing measures to prevent counterfeit products, blockchain technology can be effectively leveraged to enhance transparency, efficiency, and security in supply chain finance operations.

| Challenges in Implementing Blockchain in Supply Chain Finance | Solutions |

|---|---|

| Restricting participation to trusted and permissioned participants | Implement robust identity verification processes and access controls |

| Adopting a suitable consensus protocol | Research and select a consensus protocol that aligns with supply chain finance requirements |

| Preventing the introduction of counterfeit products | Implement product authentication mechanisms and traceability systems |

The Role of Blockchain in Enhancing Supply Chain Finance

Blockchain technology plays a crucial role in enhancing supply chain finance. By providing increased transparency and traceability, it improves coordination among supply chain partners, including buyers, suppliers, and financial institutions. The enhanced coordination in supply chain finance facilitated by blockchain ensures smoother transactions and more efficient cash movement.

One of the key advantages of blockchain technology is its ability to provide access to alternative financing options. Through tokenization and decentralized peer-to-peer lending, businesses in the supply chain can explore new avenues for accessing capital. This not only diversifies their financing sources but also promotes financial inclusion.

Furthermore, blockchain technology contributes to improving working capital management. By automating and simplifying processes, such as invoice reconciliation and payment settlements, blockchain reduces costs and minimizes delays. This, in turn, enhances the efficiency and effectiveness of working capital management, giving businesses greater control over their liquidity.

An important benefit of blockchain in supply chain finance is the reduction of fraud and counterfeiting risks. The transparent and immutable nature of blockchain transactions helps deter fraudulent activities and provides a secure environment for conducting financial operations. With blockchain, businesses can enhance trust and mitigate the risks associated with fraud and counterfeiting, safeguarding their supply chain processes.

Overall, the integration of blockchain technology in supply chain finance brings multiple advantages – enhanced coordination, access to alternative financing options, improved working capital management, and reduced fraud and counterfeiting risks. As the technology continues to advance, businesses in the supply chain can benefit from these advancements to drive their growth and success.

Image: Blockchain technology plays a crucial role in enhancing supply chain finance.

Challenges and Considerations for Blockchain in Supply Chain Finance

While blockchain technology holds great promise for supply chain finance, there are several challenges and considerations that need to be addressed. These challenges include:

- Interoperability and standardization: The lack of interoperability and standardization among different blockchain networks and platforms can hinder seamless data sharing and integration in supply chain finance. Without common standards and protocols, it becomes difficult to achieve efficient and effective collaboration between different stakeholders.

- Scalability: Scalability is a significant challenge for blockchain in supply chain finance, especially with the increasing number of participants and transactions in the network. As the network grows, transaction processing times may become slower, and costs may increase, potentially impacting the overall efficiency and effectiveness of supply chain finance operations.

- Energy expenditure: The energy expenditure associated with blockchain technology raises sustainability concerns. Blockchain networks require a significant amount of computational power to maintain the integrity and security of transactions, resulting in high energy consumption. As the focus on environmental sustainability grows, it is crucial to explore ways to minimize the energy expenditure of blockchain in supply chain finance.

Addressing these challenges is imperative for the widespread implementation of blockchain in supply chain finance. Interoperability and standardization efforts, along with advancements in scalability and energy-efficient blockchain solutions, will play a crucial role in harnessing the full potential of blockchain technology.

The Importance of Blockchain in Supply Chain Finance

Blockchain technology is revolutionizing trade by providing secure and efficient processes in supply chain finance. Its significance cannot be overstated as it enhances transparency, reduces fraud risks, and ensures accountability in supply chain finance transactions.

By creating a decentralized and transparent ledger, blockchain eliminates the need for intermediaries, thus streamlining operations and reducing costs. Through automation and simplification, blockchain technology improves efficiency and enables secure transactions, benefiting all participants in the supply chain.

With its potential to enhance coordination among supply chain partners, blockchain facilitates seamless data sharing, improved visibility, and traceability. It enables real-time access to accurate information, allowing for quick decision-making and effective risk management.

Furthermore, blockchain technology opens up new opportunities for alternative financing options, empowering businesses of all sizes. Small and medium-sized enterprises (SMEs) can benefit from direct peer-to-peer transactions and decentralized lending, democratizing access to capital.

Overall, blockchain technology is set to transform supply chain finance by revolutionizing trade and fostering secure and efficient processes. Its implementation ensures transparency, increases efficiency, and reduces costs, leading to a more resilient and sustainable supply chain ecosystem.

Conclusion

In conclusion, blockchain technology has the potential to revolutionize supply chain finance by providing increased transparency, efficiency, and traceability. By eliminating the need for intermediaries and automating processes, blockchain technology improves coordination among supply chain partners and reduces costs.

However, challenges such as interoperability, scalability, and energy expenditure need to be addressed for widespread adoption. Interoperability and standardization among different blockchain networks and platforms are crucial to ensure seamless data sharing and integration. Scalability is another challenge, especially as the number of participants and transactions in the blockchain network increases.

Despite these challenges, blockchain technology plays a crucial role in enhancing supply chain finance and has a promising future in transforming trade and finance. It offers numerous benefits such as enhanced visibility, cost savings, and access to alternative financing options. By streamlining operations, improving coordination, and providing secure and efficient processes, blockchain is set to revolutionize supply chain finance.