The Future of Banking: Trends to Watch in 2024

As you navigate the ever-evolving landscape of banking in 2024, the convergence of digital advancements and customer demands is reshaping the industry at a rapid pace. From the rise of AI-driven solutions to the expanding domain of blockchain applications, the future holds intriguing possibilities for how financial services will be delivered and experienced. Stay tuned to explore how these trends are not just shaping but redefining the very essence of banking as we move forward into the digital era.

Key Takeaways

- Continued digital transformation shaping banking experiences.

- AI integration optimizing operations and enhancing security.

- Blockchain applications revolutionizing financial processes.

- Personalized customer experiences driving loyalty and satisfaction.

- Open banking initiatives fostering innovation and collaboration.

Digital Banking Evolution

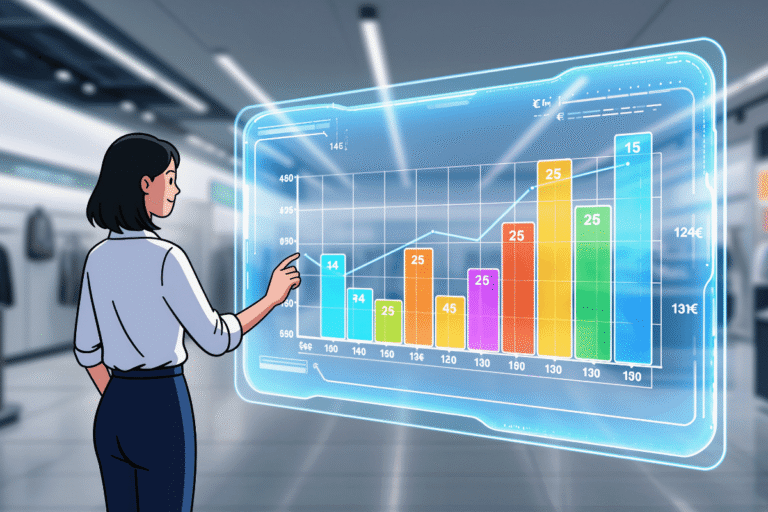

The rapid evolution of digital banking has revolutionized the way consumers manage their finances, leading to increased convenience and accessibility. Mobile payments have played a pivotal role in this transformation, with the global mobile payment revenue reaching $930 billion in 2023.

Virtual currencies, such as Bitcoin and Ethereum, have gained popularity as alternative forms of payment, with a market capitalization exceeding $2 trillion.

The convenience of mobile payments is evident in the staggering growth of transaction volume, which is expected to surpass 1.31 trillion in 2024. Virtual currencies offer borderless transactions and lower fees compared to traditional banking, making them attractive for international payments.

The rise of decentralized finance (DeFi) platforms leveraging virtual currencies is reshaping the financial landscape, with total value locked in DeFi protocols exceeding $130 billion.

As digital banking continues to evolve, the integration of mobile payments and virtual currencies will be essential in providing seamless, secure, and efficient financial services to consumers worldwide.

AI Integration

With the proliferation of advanced technologies in the banking sector, integrating artificial intelligence (AI) has become imperative for enhancing operational efficiency and customer experience. AI, powered by machine learning algorithms and data analytics, allows banks to analyze vast amounts of data quickly and accurately, leading to more informed decision-making processes. By leveraging AI integration, banks can offer personalized services, detect fraud in real-time, and streamline back-office operations.

| Advantages of AI Integration | |

|---|---|

| 1. Enhanced Customer Experience | AI enables personalized recommendations and quick query resolution. |

| 2. Operational Efficiency | Automation of routine tasks and improved risk management. |

| 3. Fraud Detection | Real-time monitoring and early fraud detection. |

| 4. Data Analysis | In-depth insights for better decision-making. |

| 5. Cost Savings | Reduced operational costs through automation. |

Blockchain Applications

Incorporating blockchain technology into banking operations offers a secure and transparent framework for transactions. Blockchain's distributed ledger system enhances security by making it nearly impossible to alter transaction records, ensuring trust among all parties involved.

One of the key applications of blockchain in banking is the implementation of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This automation streamlines processes, reduces the risk of error, and enables faster transaction speeds.

Moreover, blockchain plays a pivotal role in the rise of decentralized finance (DeFi) within the banking sector. DeFi refers to financial services that are built on decentralized networks, allowing users to access various financial products without the need for traditional intermediaries.

Personalized Customer Experiences

Utilizing advanced analytics and artificial intelligence, banks can tailor customer experiences to individual preferences and behaviors, enhancing satisfaction and loyalty. By harnessing data analytics, banks can gain valuable insights into each customer's financial habits, spending patterns, and life events. This data allows for the creation of personalized offerings, such as targeted product recommendations, customized savings plans, and timely financial advice.

The ability to provide tailored experiences not only increases customer satisfaction but also fosters long-term loyalty. Customers appreciate feeling understood and valued by their bank, leading to stronger relationships and increased retention rates. Data analytics play an important role in identifying trends and predicting future needs, enabling banks to proactively address customer requirements.

In the competitive landscape of banking, personalized customer experiences set institutions apart. Banks that leverage data analytics to deliver customized services will likely see higher levels of customer loyalty and engagement.

Moving forward, investing in advanced analytics capabilities will be key for banks aiming to excel in the field of personalized customer experiences.

Open Banking Initiatives

Open Banking Initiatives have revolutionized the financial industry by promoting transparency and fostering innovation in the way financial services are accessed and delivered. Through data sharing, banks can provide customers with personalized services, such as tailored financial advice and customized product offerings. This not only enhances the overall customer experience but also enables more efficient financial management.

Regulatory compliance is an essential aspect of Open Banking Initiatives. By adhering to regulatory standards, financial institutions can guarantee the security and privacy of customer data. This compliance framework also helps in building trust among customers, encouraging them to take advantage of the benefits of open banking.

The ability to securely share data between different financial institutions has paved the way for enhanced collaboration and partnerships within the industry. This interconnected ecosystem allows for the development of innovative financial products and services that cater to evolving consumer needs.

Cybersecurity Advancements

The increasing interconnectedness brought about by Open Banking Initiatives has necessitated significant advancements in cybersecurity to safeguard sensitive financial data and prevent cyber threats in the banking sector. In response to this growing need, banks have been investing heavily in enhancing their data protection measures and threat detection capabilities.

To provide a clearer view, let's explore the key cybersecurity advancements in banking:

| Advancement | Description | Impact |

|---|---|---|

| Data Encryption | Utilizing advanced encryption techniques to secure sensitive financial data | Mitigates the risk of data breaches |

| AI-Powered Tools | Implementing artificial intelligence for real-time threat detection | Enhances proactive cybersecurity measures |

| Biometric Security | Integrating biometric authentication methods for access control | Strengthens identity verification processes |

These advancements underscore the industry's commitment to fortifying cybersecurity defenses in the face of evolving cyber threats. By prioritizing data protection and threat detection, banks are better positioned to safeguard their customers' information and uphold trust in the digital banking landscape.

Sustainable Banking Practices

Enhancing sustainability in banking operations is imperative for long-term resilience and ethical financial practices. As the world grapples with environmental challenges, banks are increasingly turning towards green finance and eco-friendly investments to align with sustainable practices.

Data shows a significant rise in green bonds and sustainable investment funds, indicating a shift towards environmentally conscious banking. In 2023 alone, green bond issuance reached an all-time high of $1.2 trillion globally. This surge reflects a growing demand for investments that not only yield returns but also contribute positively to the planet.

Furthermore, banks are integrating environmental, social, and governance (ESG) factors into their decision-making processes. By considering these criteria, financial institutions can assess the sustainability and ethical impact of their investments.

This approach not only mitigates risks associated with climate change but also fosters responsible financial behavior.

Conclusion

In summary, the future of banking in 2024 is an intriguing blend of digital innovation and customer-centric strategies.

With the rapid evolution of digital banking, the integration of AI, blockchain applications, personalized customer experiences, open banking initiatives, and cybersecurity advancements, the industry is poised for significant transformations.

Embracing sustainable banking practices will be essential in maneuvering through the ever-changing landscape of the financial sector.

Stay tuned for the exciting developments ahead!